Interview

“Luxury spirits will rebound” – Diageo’s faith in demand for pricier fare

Demand for upmarket spirits has weakened as consumers tighten their belts but Julie Bramham, the MD of Diageo’s “luxury” spirits division, tells Fiona Holland why she remains upbeat.

Main image: Julie Bramham, managing director of Diageo Luxury Group

A year ago, Diageo launched a global division for its so-called “luxury” spirits brands. The Diageo Luxury Group principally (though not entirely) houses products priced at $100 and above. As well as Scotch brands like Brora and Port Ellen, the business unit manages 15 brand homes and visitor experiences, oversees Diageo’s cask ownership programme Casks of Distinction and runs UK-based fine-wine merchants Justerini & Brooks.

Just Drinks sat down with Julie Bramham, the division’s MD, to discuss the opportunities Diageo sees within that tier of spirits, an area she describes as “under-developed”.

Fiona Holland: Where do the growth opportunities lie for what Diageo calls the “luxury” segment in spirits and how is the company planning to take advantage of those?

Julie Bramham: What we’re seeing in the wider luxury market, outside of spirits, is a slowdown. However, what is in growth is experiences in luxury. People are really upgrading towards luxury experiences.

One of the areas that we’re starting to do a lot of exciting work in is what we call ‘experience-led luxury spirits’. That could be an out-and-out experience, fine dining, socialising, or it could be the experience that you get when you open the bottle of one of our spirits. Experience is a really big fat word but it allows us to span the areas that people can and want to access spirits – from a great mini-Martini all the way up to a bespoke blend created just for you. Experience-led and the growth of luxury experience outside of spirits is a huge area of opportunity for us.

If you think about luxury spirits, it’s not a well-developed category and we see a huge amount of growth that we can lead in luxury spirits. When we think about the consumer profile in luxury and the huge amount of growth from millennials and the older end of Gen Z really starting to interact with luxury, we see a massive opportunity for us to lead with our brands and recruit new consumers.

The opportunity for luxury spirits and personalisation is huge.

One [opportunity] is experience, the next is a broadening of the luxury consumer base that gives us a huge amount of space to grow and third is the area of personalisation. The opportunity for luxury spirits and personalisation is huge. Whether that’s through personalised packaging or blending, which really starts to take you into the top end, the opportunities for us to interact with consumers and clients on a different level with something that’s personalised to them is massively enabled [and] will continue to be enabled by things like AI.

Fiona Holland: Can you explain more what you mean by ‘experience’?

Julie Bramham: There are many ways we can use experience as an important trend in order to make sure our spirits are at the front of mind of consumers. That is from an incredible cocktail drinks experience, all way through to ‘I have a seamless experience when I buy spirits online, or when I buy them as a gift’ and ‘I know that they’re going to turn up looking beautiful,’ all the way up to hosting people at our brand homes. Over and above that, hosting clients all around the world and giving them one-off experiences. At the very top end, it could be at the brand home.

We ran an event [in August] launching a cask of Mortlach in Singapore and that was a very high-touch, white-glove experience, just for a few clients and consumers. We brought them in, we gave them an opportunity to try some liquids they would otherwise not be able to try, a wonderful three-course meal.

At one level, you’ve got very a high-touch, white-glove experience, through to brand homes. But [also] through to speaking to and consumers who just enjoy going out socialising and who want a great drinks experience. We’re spending a lot of time saying: ‘We’ve got to make sure that we’ve got strategies to win in each of those different access points.’

[Left to right] Tanqueray N.10, Don Julio 1942, Johnnie Walker Blue Label, Ketel One vodka, Casamigos Mezcal Joven. Credit: Diageo

Fiona Holland: What types of products is the division marketing and why?

Julie Bramham: Relatively crudely, we create a cut at saying spirits that sell for over $100 sit within my group. Once you start to double-click on that, my role is not only the things that sit there but also the influence of our luxury approach winning with our customers: five-star hotels, the best bars and best restaurants around the world. They might choose to access the Diageo portfolio with a broader range.

Once you get to spirits over $100, you start to talk to a different set of customers.

It’s not a clinical division. We’ve inspected consumer behaviour really closely in this part of the world. Once you get to spirits over $100, you start to talk to a different set of customers. By that, I mean bars, restaurants, luxury retail and having an approach to how we show up with those customers of ours is important. Also, you start to access a different group of consumers on a different group of occasions.

My focus is how do we start to really take the most of what is a significant growth opportunity by pulling together the competitive advantage that we’ve got in Diageo, across our portfolio, our brand homes, our private-client businesses, all into one so that we’ve got one sort of cohesive approach?

Largely our business there is Scotch, Tequila and we also have an amazing brand called Zacapa rum that also plays there. That’s largely our focus. There are other bits of our portfolio that we play. I also look after a fine-wine business called Justerini & Brooks but largely our effort is in Scotch, Tequila and, to an extent, in ultra-premium rum.

Fiona Holland: Why is there an opportunity for rum?

Julie Bramham: The answer is it’s the same across all of the categories. They are categories that are at the apex, that allow us to play across these growth areas, or trend areas, if you like. They really allow us to deliver experience. On a brand like Zacapa, we’ve got a brand home in Guatemala, above the clouds, amazing storytelling. We have a brand there that can play very credibly in the consumer areas of personalisation of experience.

You’ll see most of our effort going on whisky and Tequila but that doesn’t mean that we won’t really leverage the portfolio over time through brands like Zacapa.

Credit: Irik Bik/Shutterstock.com

Fiona Holland: What kinds of consumers are you looking to sell to? Thinking of the Don Julio 1942 miniatures as an example, are you trying to make ‘luxury’ accessible to a wider consumer base?

Julie Bramham: We have a private-client business where we sell directly to people. Some of that happens via online but a lot of it happens in-person.

With our existing client base, what we’re seeing is a lot of interest, not only in things that they may have bought before, such as the aged Scotch malts but also in moving into blends, into Tequila and into rum. We’re seeing a real portfolio opportunity with our existing client base and our innovation efforts are substantial in terms of meeting our client needs.

We’re seeing real growth in millennial and Gen Z.

I keep talking about the power of our portfolio but we’re so advantaged in terms of our footprint in Scotch and in Tequila in particular. How we’re finding ways to bring new propositions to our clients and consumers is part of Diageo’s USP. [It’s] we have these incredible brands, we have footprints, we have supply footprints that allow us to innovate and create things for our clients and consumers.

What we’re also seeing is real growth in millennial and Gen Z. That’s happening across luxury. A number of my team are based out in Singapore and what we see there is real diversity in terms of our client base. Young, very female and these clients are asking us to really keep ahead of trends, to really bring the latest cultural collaboration to them to keep real energy in the category.

Fiona Holland: The largest part of that client base you mentioned, in terms of demographics, is this an older demographic? Or are they people that tend to buy more expensive or upmarket spirits?

Julie Bramham: It is a wealthier client base, although, because of the access points, it’s not necessarily people who are all classified as high net worths and above… I do a lot of work in Dubai, as one of our luxury hubs, and we really see there what we call ‘holiday millionaires’. These are people who save up it all year, go and have an amazing holiday spending money on luxury things and luxury dining, luxury drinks, et cetera.

Our consumer base is quite broad because our access points go from a special occasion, an amazing meal out or cocktails out, all the way up to clients who might want to buy a cask from us.

Fiona Holland: In terms of sales channels, are you focused more on the on-trade, global travel retail, off-trade?

Julie Bramham: It’s really important that we’re in the on-trade. To all of the conversation about experiences, a lot of that experience does happen in the on-trade and in the luxury end of the on-trade. Showing up with the most incredible quality cocktails and drinks is a real focus for us.

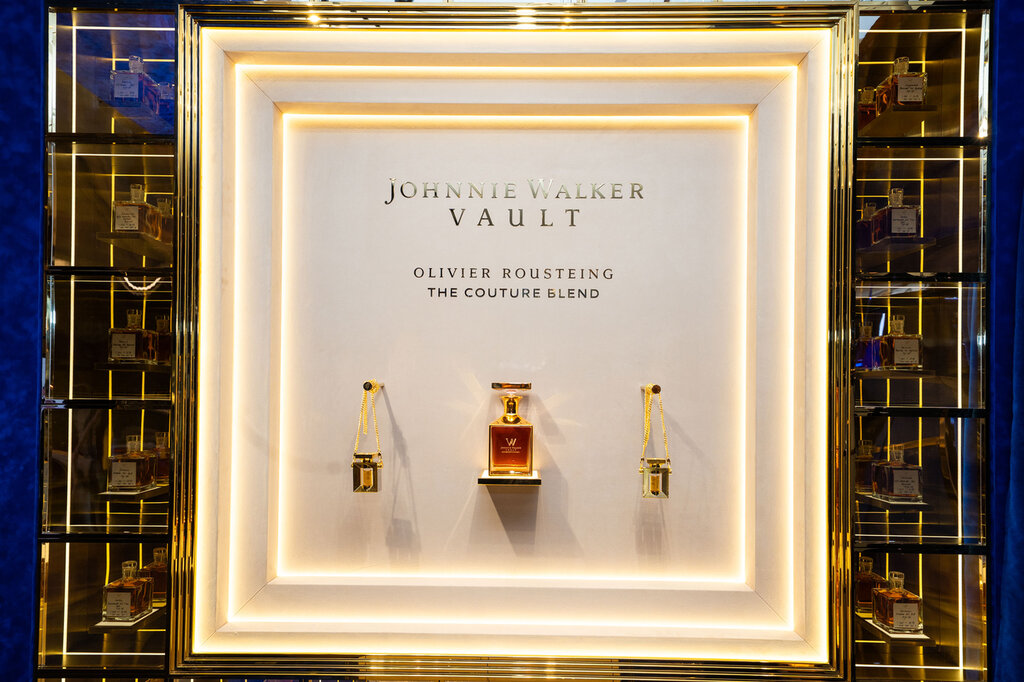

Luxury retail is important. We’re doing a big showcase with Harrods. We’re launching a product from Johnnie Walker, the second in our collaboration series from [fashion designer] Olivier Rousteing.

Experience can happen in retail as well as in the on-trade, it just shows up slightly differently.

We’re taking the windows, we’ve got a shop-in-shop space inside which allows consumers to come try liquids, personalise bottles… We’ve got personalised stoppers that Olivier has designed just for Harrods and then there’s a line of products that are only available [there]. It starts to bring to life a lot of the elements that we’ve spoken about on experience and personalisation. Experience can happen in retail as well as in the on-trade, it just shows up slightly differently.

Fiona Holland: Are there specific geographic markets you’re looking to target?

Julie Bramham: We’re doing a lot of work in London, Dubai, Singapore and with global travel at the very top end. That allows us to talk to consumers and clients who travel around the world at the very top end of our price tiers, they can be people who have houses in reachable locations.

You’re going to see... work coming in London at Harrods and also with the Rosewood [hotel] and the new opening on Chancery Lane and with a big customer in Singapore, all on Johnnie Walker.

Once you get to cocktails and access points that are slightly further down the price ladder, key cities all around the world are a focus… We’re very good at mapping luxury cities and knowing and understanding which are the customers within those luxury cities that are most important for us to target. Expect to see us all around the world in the right customers. But, at the very top end of our price point, we’re focused on a few cities at the moment.

Fiona Holland: Are there emerging markets that you expect will become more important?

Julie Bramham: We’ve been doing a lot of work in Lagos. We’ve got a great customer there. It’s a very vibrant on-trade scene. There’s a lot of luxury spend. When we talk about the 20 to 30 most influential cities, that is a mixture of slightly more developed spirits markets and the more emerging spirits markets as well.

Fiona Holland: Given ongoing muted consumer confidence, is it a tough time to be selling ‘luxury’ spirits? Are there enough consumers out there that are looking for a more upmarket option?

Julie Bramham: Our fact-based view is absolutely there is slowdown in wider luxury. A lot of that is driven by personal goods and we all know a lot of that is driven by high levels of pricing activity that happened through Covid. And now the industry is slowing down.

Within spirits, premiumisation is a long-term trend and we can see that continuing. Luxury spirits have slowed down in the last 18 months and we expect that slowdown to continue but it will rebound. When you look at the luxury end of spirits, what you tend to see is it follows and grows ahead of spirits, then it falls with spirits and then it follows and grows ahead of spirits again.

A lot of what’s happening in luxury spirits is Cognac-based, which is not a part of the category that we participate in. We’re feeling really good, through whisky, Tequila and rum, about our opportunities to build and grow in these parts of the category that are growing: experience-led personalisation through whisky, through Tequila, et cetera.