- ECONOMIC IMPACT -

Latest update: 7 July

There is a real risk of a return to the ‘stagflation’ that characterised the 1970s. The World Bank has lowered its global growth forecast for 2022 from 4.1% to 2.9%, with a warning that many countries may see recessions.

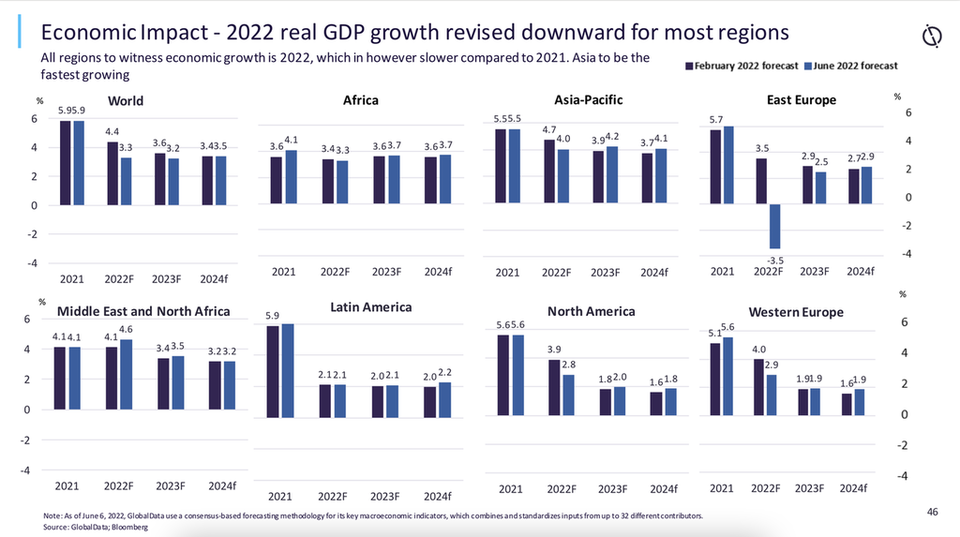

Against this backdrop, GlobalData forecasts the world economy will grow by 3.3% in 2022, following 5.9% growth in 2021. At the same time, the global inflation rate is projected to rise to 7% in 2022 from 3.5% in the previous year.

Global geopolitical tension is increasing the risks involved with investment and trade, as well as causing fluctuations in consumer demand. An ongoing conflict between Russia and Ukraine will continue to impact global growth in terms of production, trade and employment. Major economies will continue to adopt tighter monetary policies to tame inflationary pressures amid rising oil and natural gas prices.

GlobalData anticipates the Middle East and north Africa (MENA) will be the fastest-growing region in 2022, with its real GDP growth rate forecast to hit 4.7%, followed by Asia-Pacific (3.9%), Africa (3.4%), western Europe (2.9%), North America (2.8%), Latin America (2.1%) – while eastern Europe is predicted to see its real GDP fall by 3.3%.

44%

More than four in ten employees report an increase in productivity while they’ve been working from home, according to a GlobalData survey.

43%

The percentage of employees still working at home on a full-time basis, GlobalData research shows. Some 27% of survey respondents said they are now working at the office all week.

All major economies are expected to bounce back in 2021

- SECTOR IMPACT -

INFLATION AND CONSUMERS

Many manufacturers had already begun to pass price increases on to consumers before the Ukraine crisis and these moves have continued.

Movements on price remain a key strategy for manufacturers to offset the impacts of rising inflation. Major beverage groups, from Carlsberg to Heineken and from The Coca-Cola Co. to Campari have moved to up prices in recent quarters. Some drinks groups, including PepsiCo and Danone, have indicated they are likely to look to increase prices further.

The crisis has added to the inflation pressure consumers were already facing as the global economy opened up after the depths of the pandemic. Changes in consumption patterns are being seen across FMCG categories, as shoppers grapple with rising prices, higher energy and fuel costs, and squeezed disposable incomes.

However, many drinks companies have said consumer demand appears to be broadly holding up despite rising prices.

Speaking to Just Drinks last month, Paul Graham, the MD of the UK arm of soft-drinks group Britvic, said: “Historically, soft drinks have remained resilient in times of economic downturn compared to other categories but we are in uncharted water here… the scale [of inflation] is so big.

“We’re probably testing the modelling in terms of what we have seen. I still think soft drinks offer great value for money, a great choice of products and great variety for a multitude of occasions, so I am pretty confident the category will stay resilient.”

“From an elasticity perspective, it’s probably too early to say. Because we are coming out of a very inconsistent baseline with coming out of lockdown and hospitality recovering a year or so ago, just looking at year-on-year comparisons doesn’t paint a true picture. What I will say is that we haven’t seen anything outside of what we would expect at this point in time in terms of consumer behaviour.”

Selected drinks company Q2 results