- ECONOMIC IMPACT -

Latest update: 14 July 2020

Goldman Sachs forecasts the US economy to contract by 4.6% in 2020.

100 million workers in 35 advanced and emerging nations were unable to do their jobs remotely and are at high risk, according to the IMF.

7.4%

Unemployment rate in the eurozone stood at 7.4% with 12.15 million unemployed in May.

4.6%

Fitch Ratings forecasts the global economy to contract by 4.6% in 2020.

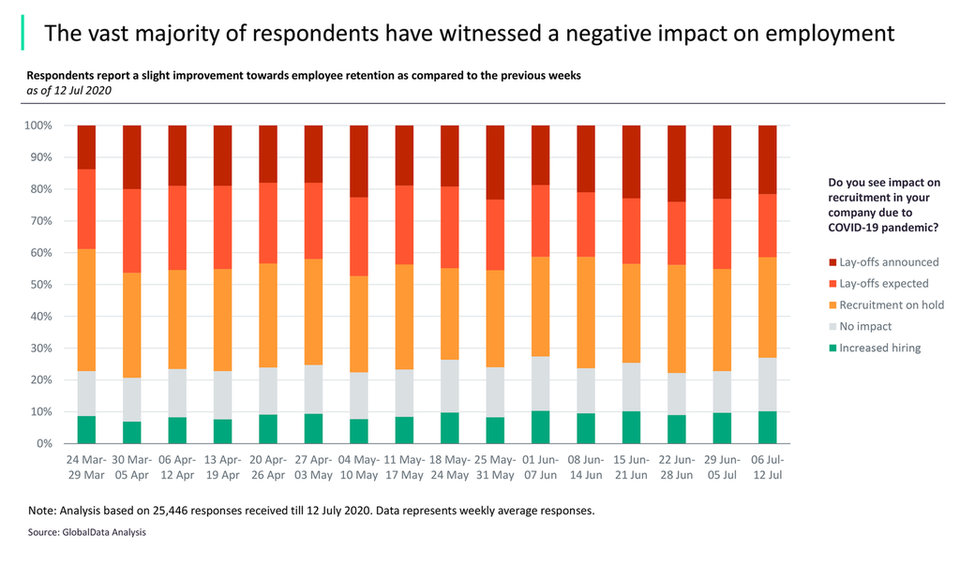

Impact of Covid-19 on employment

- SECTOR IMPACT: CONSUMER & FOODSERVICE -

Latest update: 15 July 2020

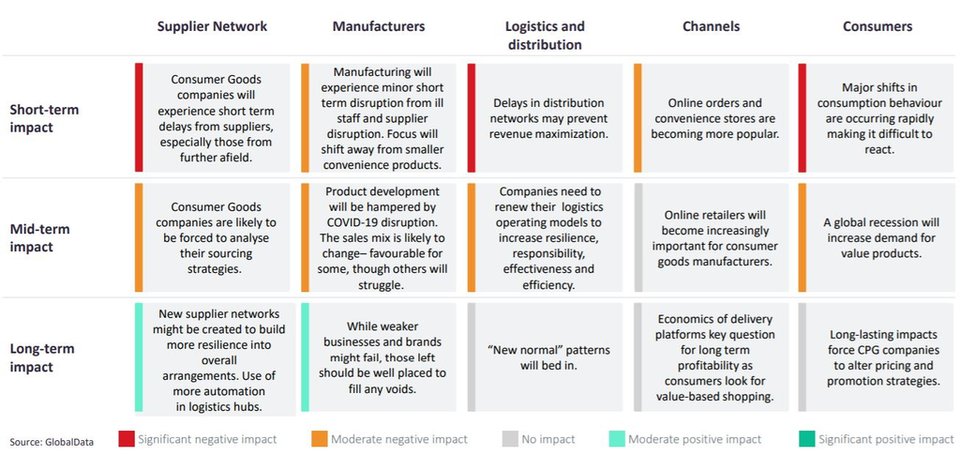

consumer market impact

Unemployment and low consumer confidence continues to affect willingness to spend. Online delivery services and platforms continue to be leveraged by brands as risk-aversion is likely to characterise consumer behavior in future.

-3.9%

GlobalData’s latest forecasts show a decline of -3.9% in consumer products for 2020 compared to baseline predictions, equivalent to $358.2bn in lost revenue.

Covid-19 could change longer-term consumer behavior and the most successful companies will alter their strategies to accommodate this

Overall, the market value of alcoholic drinks in 2020 will fall by -14.1% compared to baseline predictions. Beer & cider, wine and spirits will each experience decline.

From 2020-2023, the sector will experience a slow recovery, reducing the gap between the 2023 "slowdown“ forecast vs baseline forecast to –8.9%.

Non-alcoholic drinks will decline in 2020 vs the baseline forecast by -8.3% and all categories will decline.

Iced RTD tea and coffee drinks, energy & sports drinks and carbonates will see most decline, potentially linked to fewer on-the-go occasions. Hot Drinks, JNSD and water will see less decline comparatively.

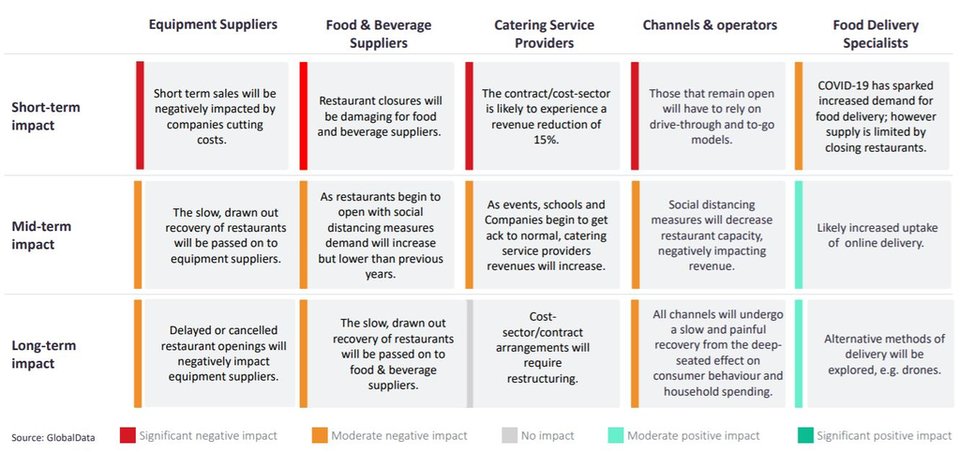

foodservice market impact

All foodservice outlet types will see double-digit declines in 2020. Losses are predicted beyond this period as consumers will continue to prioritise basic food supplies over foodservice offerings despite significant developments and innovation in direct-to-consumer foodservice offerings.

GlobalData’s latest forecasts show a decline of -29.7% in profit sector operator sales for 2020 relative to the 2020 baseline forecast, equivalent to $1tn in lost revenue.

Pubs, clubs & bars are set to experience significant decline in 2020 vs baseline forecast, with -37.1% representing $169m value loss.